Defining SRI and Impact Investing

SRI and impact investing are both mission-driven approaches to generating positive outcomes through investment vehicles. Socially Responsible investing (SRI), also known as values-based or ethical investing, refers to the practice of integrating social and environmental factors within investment analysis to avoid investing in companies that have negative impacts on the environment and/or society. Impact investing integrates social and environmental factors in investment analysis, similarly to SRI, but goes further by making investments in organizations, companies and/or funds whose core mission is to generate social and/or environmental impact alongside financial return (To learn more about Impact Investing, see: Impact Investing 101). While both types of investments integrate nonfinancial factors in investment analysis, the key differences between the two lie in the strategies used to accomplish positive outcomes as well as financial return expectations.

SRI and impact investing are both mission-driven approaches to generating positive outcomes through investment vehicles. Socially Responsible investing (SRI), also known as values-based or ethical investing, refers to the practice of integrating social and environmental factors within investment analysis to avoid investing in companies that have negative impacts on the environment and/or society. Impact investing integrates social and environmental factors in investment analysis, similarly to SRI, but goes further by making investments in organizations, companies and/or funds whose core mission is to generate social and/or environmental impact alongside financial return (To learn more about Impact Investing, see: Impact Investing 101). While both types of investments integrate nonfinancial factors in investment analysis, the key differences between the two lie in the strategies used to accomplish positive outcomes as well as financial return expectations.

Positive/Negative screening is a key difference between SRI and impact investing as they indicate an investor’s level of activity in pursuing positive impact through investments.

Negative screening refers to an investor’s strategy to intentionally avoid investing in companies or organizations that are counter to the investor’s nonfinancial values. SRI investors and fund managers integrate negative screens in investment analysis to avoid investing in industries or companies based on environmental and/or social factors; examples of negative screens include avoiding investments in the alcohol, gambling, tobacco and military industries. Often referred to as a “do-no-harm” approach, negative screening is a relatively passive strategy to ensuring an investment portfolio does not cause negative social outcomes.

Positive screening, on the other hand, refers to the pursuit of investments in companies and organizations that aim to generate a positive social and/or environmental impact. Impact Investing takes an active approach to generating positive impact by investing in companies whose core business model integrates positive impact creation rather than just negative impact avoidance. Examples of impact investments include investments in organizations that support underserved communities, community development or sustainable energy.

Financial Return Expectations

Within mission-driven investing, there is varying prioritization of positive impact creation in relation to financial returns.

In SRI, while investors aim to avoid investments in harmful companies and industries, the intent is still to maximize financial returns. Thus, investment managers practicing SRI have a fiduciary duty to their investors to make investment decisions in order to generate the highest rates of return.

Impact investors, on the other hand, vary in their financial return expectations. While some impact investors seek competitive or market-rate returns, others may be willing to accept below market-rate returns in order to maximize impact.

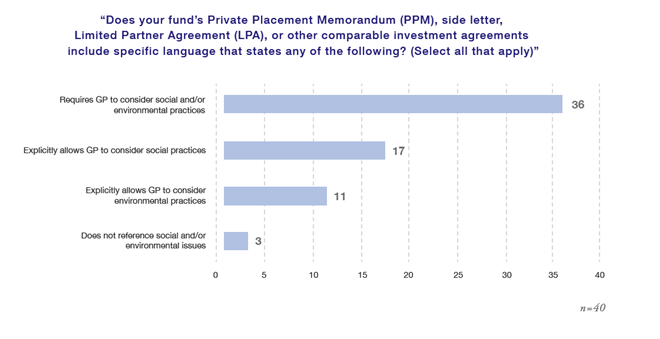

However, it is important to note that fiduciary responsibility to investors and pursuit of positive impact are not necessarily mutually exclusive. For instance, in a study conducted by the Wharton Social Impact Initiative, the majority of impact fund managers sampled explicitly state their level of intention to pursue and generate impact in their limited-partner agreements, private placement memorandums and other investment agreement documents (See Figure 1). As a result, some impact fund managers are legally obligated to meet the requirements set forth by their investors regarding the extent to which impact factors are incorporated in investment analysis.

Fig. 1 . Source: Wharton Social Impact Initiative report Great Expectations Mission preservation and Financial Performance in Impact Investing; October 2015. See more at: Profits and Purpose: Wharton Study Finds that Impact Investments Can Produce Both Market-Rate Returns and Long-Term Impact

Is It All Semantics?

While SRI and impact investing have key differences, both fall within the spectrum to which an investor can integrate mission into their portfolio. Both SRI and impact investing rely on nonfinancial metrics to determine the impact – positive or negative – that a company or organization may have on the environment or the surrounding community. And, while one of the key differences between SRI and impact investing may be financial return expectations, there is a growing body of evidence supporting the ability of impact investments to produce and, at times, outperform the market rate of return when compared to non-impact investments (To read more about the performance of Impact Investments, see: The Financial Performance of Impact Investments). Regardless of the approach used by investors, both SRI and impact investing are a testament to the various ways values-based investing can be incorporated into an investment strategy.