Merrill Lynch Publishes White Paper Regarding Impact Investing

In a white paper published by the Merrill Lynch Wealth Management Institute, Anna Snider, Head of Global Equity and Impact Investing Due Diligence, provides an overview of the contemporary impact investing landscape, derived from analysis of academic research and industry data. “Impact Investing: The Performance Realities” discusses risk assessment in impact investing, the growing body of evidence surrounding the financial performance of impact investing, and key development challenges to the impact investing industry.

Some key findings and observations include:

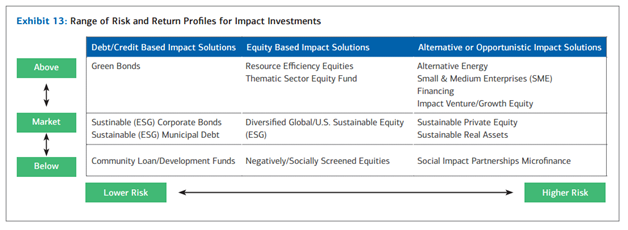

- Impact Investment Risks and Returns – While impact investments are not generally riskier than traditional investments, the risks involved are usually different and important to understand.

Exhibit 13: Range of Risk and Return Profiles for Impact Investments

The white paper represents the range to which investors should consider impact investment risks and returns by illustrating the impact investing universe across public and private instruments (Exhibit 13). The paper addresses the issue of scale and capacity for higher risk and return impact investments, such as alternative energies or impact venture/growth equity, and the common issue of smaller private markets being able to absorb significant inflows or outflows of capital. Conversely, lower risk and return investments, such as microfinance or community development loans, may provide relatively higher social impact but below market returns to investors.

The paper also observes that using ESG-related criteria in making investment decisions can actually help investors develop more robust financial analysis by accessing risks that may not be found on a balance sheet; Anna Snider notes that “from a practical standpoint, using impact analysis to evaluate companies can help mitigate risk, regardless of whether the investment is being evaluated for impact.” - Impact Investment Performance – Impact investments can produce market-like returns and may, at times, outperform their traditional counter parts. However, investment performance is largely dependent upon investment strategy, and additional research is required in order to avoid generalized conclusions on impact investment returns.

While impact data can aid in reducing portfolio volatility by helping investors and managers identify non-financial risks important to a company’s financial performance, an impact-oriented impact strategy can also help produce long-term returns. As sustainability and impact factors – through both positive and negative screens – become more commonly integrated into investment strategies, impact investing provides the investor the ability to not only have positive impact, but also the opportunity for long-term financial growth. - Development and Challenges of Impact Investment Industry – The impact investing industry has developed tremendously in the last decade, largely in response demand from the investor community and consumer trends. For instance, by 2014, 80% of S&P 500 companies issued corporate social responsibility reports, whereas only 20% of companies in the same index issued such reports in 2011.

With this growth in impact reporting integration, there has also been a growth in aggregate data sources and service on social impact. And, while efforts are currently underway by organizations such as the Sustainability Accounting Standards board, there is still no industry-wide accepted measurement framework to define impact investments and further quantify impact.